Do you ever wonder why your car insurance costs so much? It might be because of where you live. If you’re a shopper looking for cheap car insurance, click the button below to find the average price of car insurance in your neighborhood.

Simply enter the address and zip code where your car is typically parked overnight. We can then tell you the average price of car insurance in your neighborhood. Depending on where you live, the variation can be extreme.

Don’t Skimp on Quality

Almost every television ad about insurance promotes cheap car insurance. However, don’t skimp on quality. Price isn’t everything when it comes to insurance. In fact, insurance that won’t pay a legitimate claim was a waste of money, no matter how cheap it was.

ValChoice finds that good quality car insurance doesn’t cost much more than the discount brands. In fact, the different is often less than the morning cup of coffee budget for many people. Yes, for slightly more, it’s possible to get first class protection.

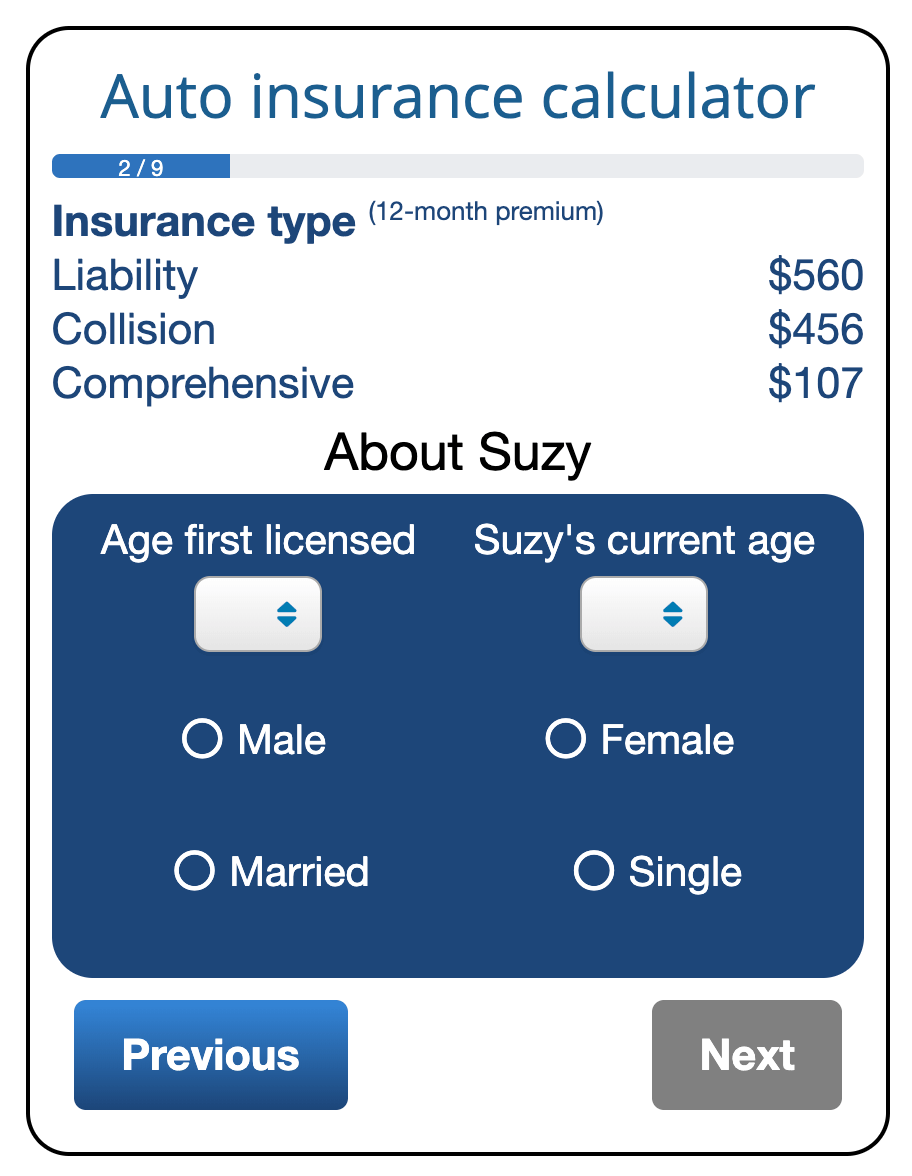

Start by finding out what is a fair price for insurance by using the calculator below. The ValChoice car insurance calculator will tell you the average cost of insurance for your exact situation.

Not Everyone Can Get Cheap Car Insurance

ValChoice collected massive amounts of data showing which areas of the country have the highest accident rates. We also examined how hundreds of different insurance companies use this information to rate consumers of insurance. Our calculator works in all 50 states. Simply click the button above and enter your address to find the average price for your neighborhood.

Why are some neighborhoods more expensive?

There are several reasons where you live impacts car insurance prices. The major items that impact geographic risk include:

- Accident frequency – this is how often accidents occur

- Accident severity – the damage that occurred and the cost of repairing the damage

- Laws that can have the impact of increasing the cost of accidents

The first item above is impacted due to population density. Simply said, more densely populated areas have higher accident rates. The second item is directly impacted by speed. Areas with high speed limits tend to have a higher severity level. These two items can go hand-in-hand. Densely populated areas also have more freeways which have higher speeds. This combination of items directly impacts insurance rates. State laws also have a major impact on insurance prices.

Would I save money by moving and commuting to work?

Maybe. However, you need to realize that if you driver more, that will increase your insurance price as well. The more you drive, the more likely you are to have an accident.

If you want to know how much moving could save you, it’s easy. Click the button above and use our calculator. All you do is go through the calculator once based on where you currently live and again based on where you would move. The calculator also asks if you commute to work and how many miles you drive. Going through the calculator for both locations will give you a detailed estimate of the difference in price before and after a move.

Why You Need the Car Insurance Calculator

Do you want to know any of the following:

- Is your current insurance company charging a fair price?

- Would you rather not talk to an agent to get an answer to the question above?

- Do you wonder what insurance would cost on a new car?

- Are you going to be adding a driver to your policy?

- Do you wonder what the cost would be if you, or someone else, got a ticket, had an at-fault accident or a DWI?

Do you prefer quality insurance?

When shopping for insurance, always start by finding out if what you already have is good. That’s easy to do. Click the buttons below to get a free rating on both your auto and home insurance. This free rating will show how your insurance company performs relative to all other companies in the industry.

If the rating you just got was good, tell a friend. If not, here’s a list of the best insurance companies in your state. Click the buttons below to find the best car insurance and best home insurance where you live.

Why We Built the Car Insurance Calculator

ValChoice is focused on helping people with insurance by delivering transparency into what has been an opaque industry. After doing a detailed analysis of insurance prices, we found the price variations to be extreme. Shockingly, comparing the exact same coverage, person, car, etc across different insurance companies can result in a 20x difference in price. Across seven common scenarios we tested, we found an average of an 8x difference.

We immediately recognized that consumers need a fair, unbiased, free service that lets them know what is a fair price for insurance. That’s our calculator. Try it out. Tell a friend about it.

No comments yet.