Yes. In most states your credit score affects the price of your car insurance. Most people want affordable auto insurance. If you have a good or excellent credit score, getting affordable auto insurance is possible. If you have poor credit, your options are limited. Click the button below to find out how credit score affects car insurance prices where you live.

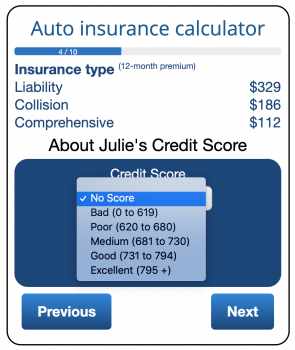

Below is an image showing the ValChoice car insurance calculator. The image shows where credit score is input in order to determine insurance price. Go to the calculator and change your credit score. You will see how your credit score affects your car insurance price.

The ValChoice car insurance calculator is interactive. Therefore, as you enter information like your credit score you immediately see the calculations change. Simply change your credit score and see how your insurance price changes. Finally, you can know what affordable auto insurance means for you.

What’s a fair price for affordable auto insurance?

It’s hard for people to know what a fair price is for auto insurance. Ads bombard us constantly about saving money, only paying for what we need, getting better protection, etc. Unfortunately, none of these ads have any meat to them proving the company is better or different. These ads only prove which companies have the largest advertising budgets.

Therefore, to break through this noise and help people, we built the ValChoice car insurance calculator. Below is a screenshot of the calculator showing the page where credit score is input.

The ValChoice car insurance calculator is interactive. Therefore, you can enter a credit score and see the auto insurance price estimates change. Checkout the impact on your car insurance premium due to credit.

States that don’t allow using credit scores to calculate car insurance rates.

At the time of this writing, there are six states that don’t allow credit scoring to be used in calculating car insurance premiums. Those states include:

- California

- Hawaii

- Massachusetts

- Montana

- North Carolina

- Pennsylvania

All 44 other states allow the use of credit scoring when calculating insurance rates.

The case for excluding credit scores when calculating car insurance premiums.

Disallowing the use of credit scores lowers the price of car insurance for people with poor credit. Conversely, it increases the price of insurance for those with good credit scores.

The arguments for and against using credit scoring in pricing insurance is as follows:

- For: The insurance industry reports a tight correlation between credit score and claims. Therefore, people with low credit scores cost significantly more to insure.

- Against: Consumer protection advocates promote sharing the risk more broadly in order to make having insurance more affordable to low income people.

The ValChoice Car Insurance Calculator

ValChoice is focused on helping people with insurance by delivering transparency into what has been an opaque industry. After doing a detailed analysis of insurance prices, we found the price variations to be extreme. Shockingly, comparing the exact same coverage, person, car, etc across different insurance companies can result in a 20x difference in price. Across seven common scenarios we tested, we found an average of an 8x difference.

We immediately recognized that consumers need a fair, unbiased, free service that lets them know what is a fair price for insurance. That’s what our car insurance calculator does. Try it out. Tell a friend about it.

The ValChoice Video Education Series

In addition to the car insurance calculator, ValChoice produced a series of educational videos. You can find them free-of-charge on the ValChoice Youtube channel. Below is a link to the video specific to how credit score impacts the cost of car insurance.

Hopefully, this helps you make a more informed insurance buying decision.

No comments yet.