Most people think that the more you pay for insurance, the better you will be covered and the better service you will receive. Unfortunately, the facts don’t support this belief. In fact, when it comes to collecting an auto insurance claim, where you live can be a bigger factor than what you pay for your insurance. This is the second of two posts demonstrating that auto insurance owners that pay a high price for their insurance do not necessarily get better protection than consumers buying low-priced insurance.

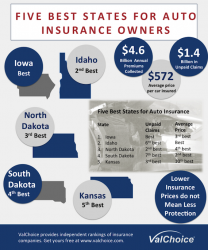

Best States for Auto Insurance Owners

To demonstrate the lack of an association between price and protection, ValChoice set out to identify the five best states for getting a good value from the dollars spent by auto insurance buyers. The analysis was based on two important factors: 1) The average annual cost of auto insurance, and 2) the amount of unpaid auto insurance claims outstanding in the state. The results of the analysis were that the following five states had the best combination of low price and good protection:

- Iowa: Lowest (best) level of unpaid claims, 3rd best price

- Idaho: 6th lowest in unpaid claims, best price

- North Dakota<: 2nd lowest in unpaid claims, 4th best price

- South Dakota: 7th lowest in unpaid claims, 2nd best price

- Kansas: 3rd lowest in unpaid claims, 10th best price

This post was first published in the Huffington Post. To have interesting content from ValChoice delivered directly to your email box, subscribe to ValChoice.

What Auto Insurance Owners Need to Know

Demonstrating that good protection is not directly related to the price paid, all five of the states with the lowest amount of unsettled auto insurance claims, on a per policy basis, are also among the least-expensive states for buying auto insurance.

The take away from this analysis is that for auto insurance owners buying insurance, price is not a good measure of the quality of the insurance purchased. It goes without saying that advertisements are the worst way of deciding where to buy insurance. Instead, analysis of which companies provide the best value is the only option to ensure you get insurance with the price, protection and service you expect and deserve.

Are you wondering how good the auto insurance you buy is? Click this button and find out.

The calculations to identify the five best states for auto insurance owners were done as follows. The total unpaid claims[i], per state, was divided by the number of auto insurance policies[ii] sold in the state. This amount was then added to the average price of auto insurance in that state[ii]. The result is a combined annual cost with the per capita, outstanding, unpaid claims amount added to the cost.

[i] © AM Best Company, Used by Permission

[ii] Insurance Information Institute, iii.org

No comments yet.