It’s no surprise that home insurance prices vary dramatically from state to state. Homeowners in states with higher risks are of course going to pay more than homeowners in a state with few risks.

This article was originally posted on the Huffington Post by the ValChoice founder. Click here to see the original post.

The more interesting way to look at insurance is the value the consumer gets for their money. The value of insurance can be determined by looking at how much of the money collected by insurers in premiums is returned to homeowners to cover damages. When looking at value, most people expect the various regions of the U.S. to be similar. Surprisingly, there is large variation, and there is no clear correlation between risk and value.

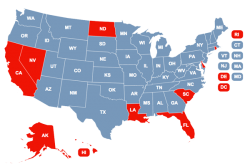

Ten Worst States for Getting Value From Your Home Insurance

As the list below shows, the ten worst states for getting value from one’s home insurance are not what consumers would expect. Below is a listing of the ten lowest value states for home insurance:

- 1st worst – Hawaii

- 2nd worst – Florida

- 3rd worst – Louisiana

- 4th worst – Nevada*

- 5th worst – North Dakota

- 6th worst – South Carolina

- 7th worst – Delaware

- 8th worst – Rhode Island

- 9th worst – California

- 10th worst – Alaska

- The District of Columbia, if a state, would replace Nevada as the 4th worst.*

Relationship Between Price and Value

The analysis gets even more interesting when comparing how state rank for both price and value.

- Hawaii – 50th (worst) for value**; 26th for price***

- Florida – 49th (second worst) for value**; 1st (highest) for price***

- Louisiana – 48th for value**; 3rd for price***

- Nevada – 47th for value**; 46th for price***

- North Dakota – 46th for value**; 20th for price***

- South Carolina – 45th for value**; 14th for price***

- Delaware – 44th for value**; 45th for price***

- Rhode Island – 43rd for value**; 7th for price***

- California – 42nd for value**; 31st for price***

- Alaska – 41st for value**; 30th for price***

At the opposite extreme is Florida: the most expensive and the second lowest value. Some may say that’s because there haven’t been severe hurricanes recently. However, that’s not the case. This analysis is done over a ten-year period in order to account for catastrophic events. To get this information on any of the 50 states, click here.

Is Selling on Price Hurting Consumers?

For many industries, selling on price can lead to disastrous results. While price is clearly important to consumers, many industries put significant effort into explaining why the price they offer is also a good value. Not the insurance industry.

With insurance, we constantly hear the advertisements offering 15% savings or $500 savings or other similar messages. In the case of insurance, buying on price is a practice the industry promotes, but one that hurts consumers.

A Reality That Favors the Largest Insurers

Lacking other metrics to help make informed purchase decisions, consumers assume some level of equivalence among product offerings.

Interestingly, this reality also disadvantages many of the best insurers in the industry. Smaller regional companies lacking both the advertising budget to compete in branding wars are losing market share.

Transparency is the Solution

There is a win-win solution. Transparency into the opaque insurance industry not only benefits consumers, it also benefits the carriers that aren’t spending massive sums of money on expensive advertising campaigns.

Transparency will bring an increased level of focus on policyholders and their needs. Insurance industry transparency needs to be adopted by regulators, legislators and the industry itself.

No comments yet.