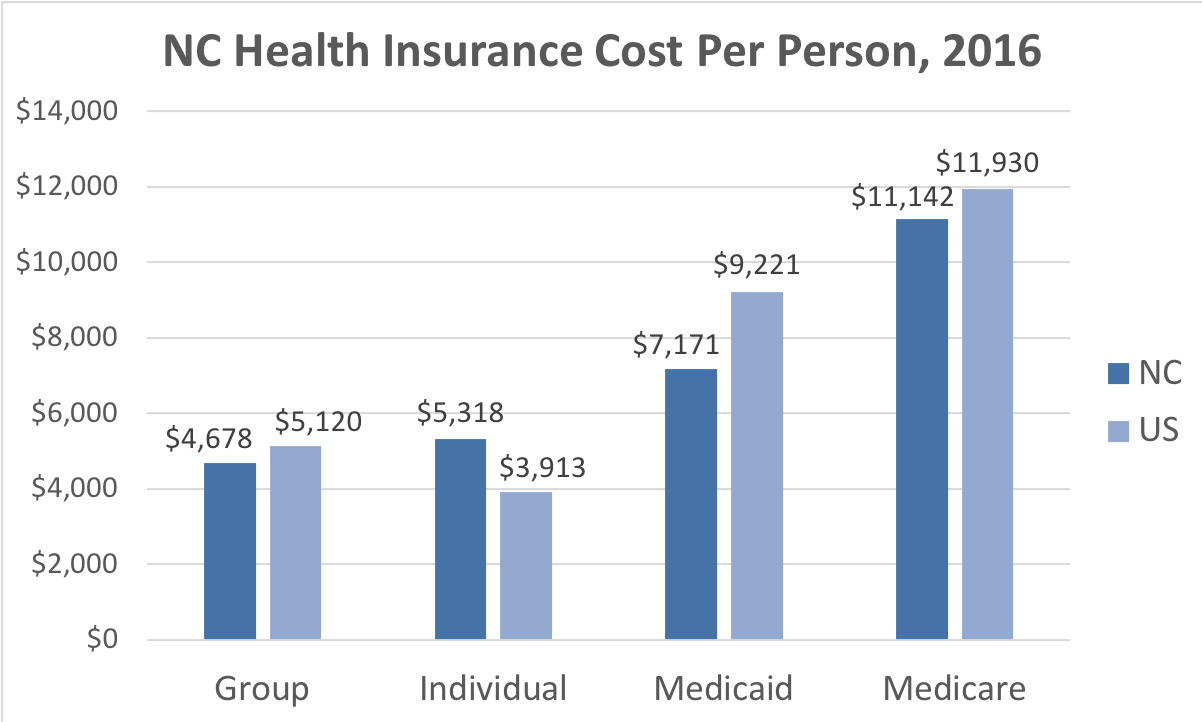

The Cost of Health Insurance in North Carolina

The average cost of health insurance in the state of North Carolina is $6,352 per person based on the most recently published data. For a family of four, this translates to $25,408. This is $629 per person below the national average for health insurance coverage. However, health insurance costs vary significantly based on the cost of care and the population insured. The chart below shows the four major insurance types available in North Carolina. The dollar amounts shown on the chart are the average cost in North Carolina to insure people for each type of insurance.

North Carolina Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 587,849 enrollees and individual insurance is based on 684,593 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

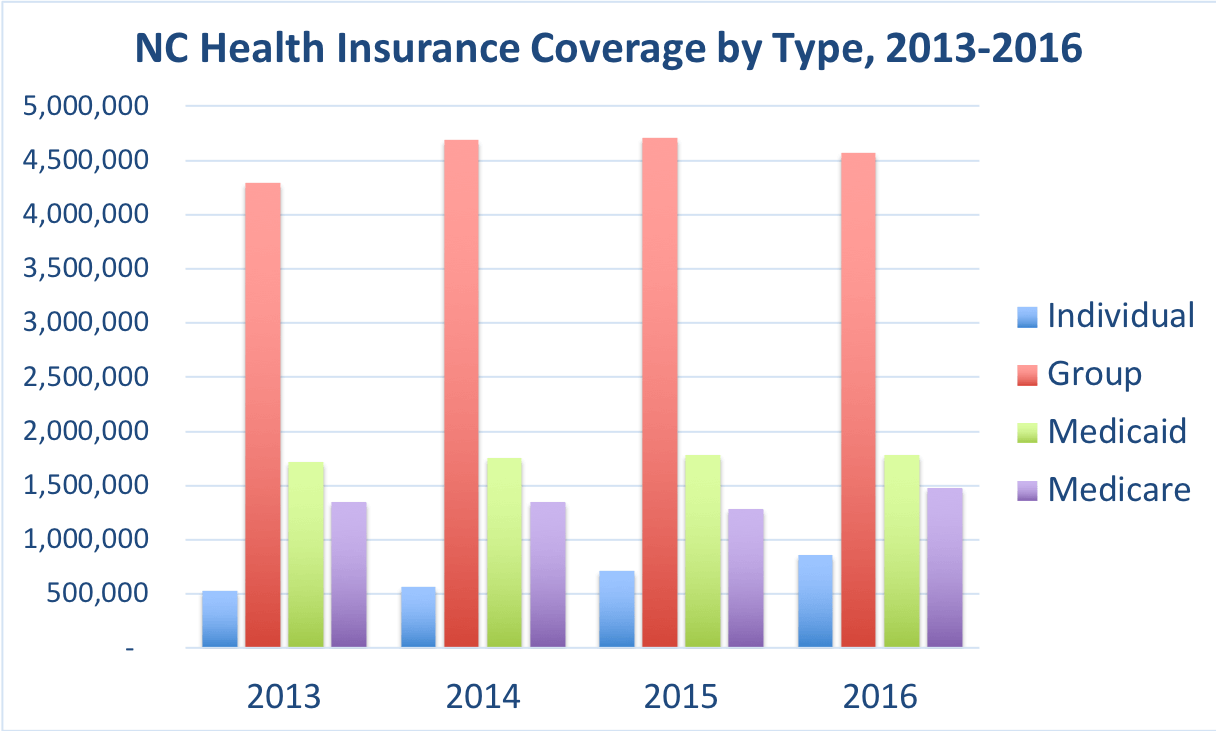

Number of People Covered by Health Insurance in NC

The chart below shows the number of people insured with each type of insurance plan available. The most recent reported year plus three-years of history is shown.

Number of People Covered by Type of Health Insurance

Data from the Kaiser Family Foundation.

Trends identified in the above data include an increase in the number of people with group, individual, Medicaid and Medicare coverage. The largest increase in the number of people insured was with individual coverage increasing by 333,700 enrollees.

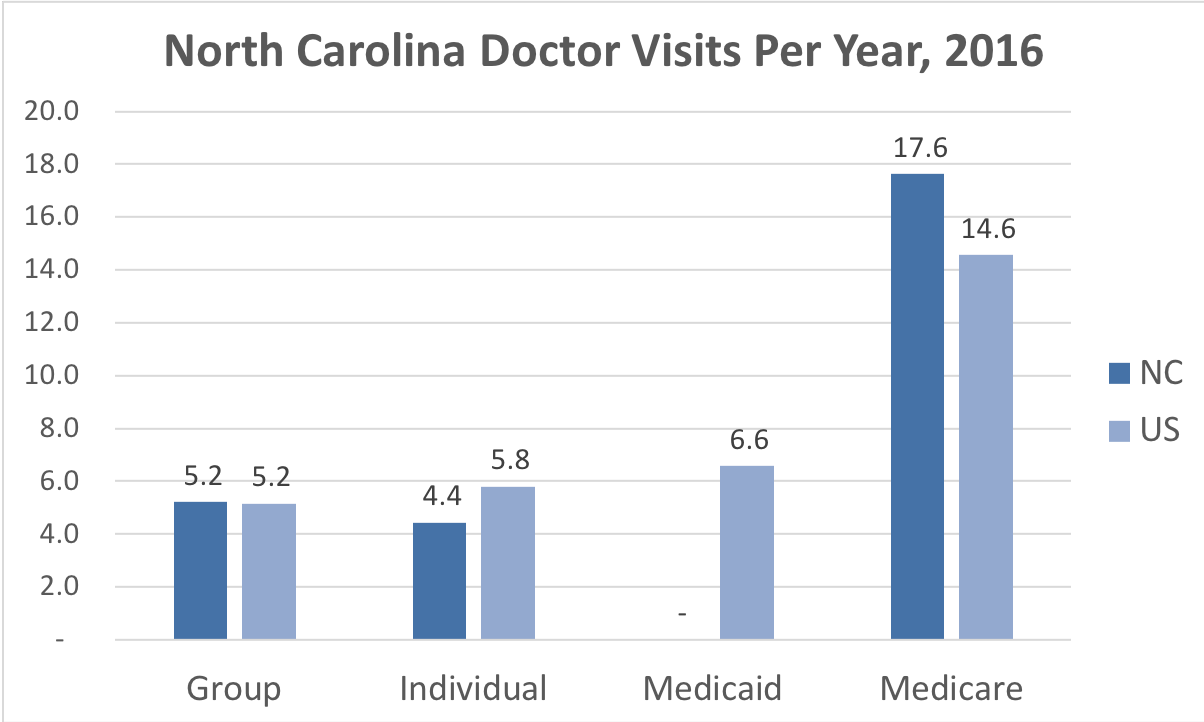

Health Services Use by North Carolina Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 587,849; Individual insurance, 684,593; and Medicare Advantage, 493,211. North Carolina does not offer a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the charts below.

NC Doctor Visits, Per Person, Per Year by Insurance Type

This type of care includes visits to doctors in which the patient was not in an institution such as a hospital.

The frequency of doctor visits among residents with group coverage was equivalent to the national average. People covered with individual insurance had approximately a 25% lower frequency of doctor visits than the national average. Medicare Advantage enrollees had approximately a 25% higher frequency of doctor visits than the national average. North Carolina does not offer a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

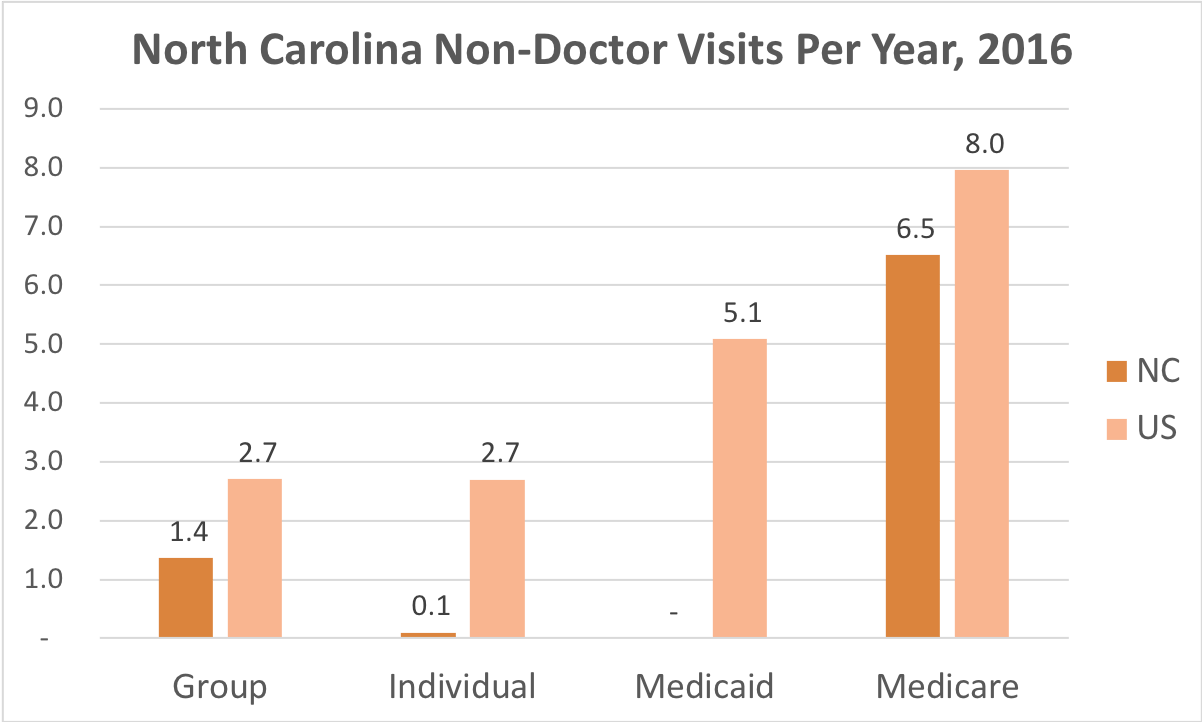

Frequency of Using Medical Services Other Than a Doctor or Hospital

Non-doctor health care visits is a measure of how often people receive medical care without seeing a doctor. This type of care excludes patients that have been admitted to hospitals or other institutions. Examples of non-physician health care includes appointments or walk-in clinics to see a nurse, physical therapist, counselor for mental health appointments or other non-physician medical personnel.

People covered with group insurance used this type of health care at approximately half the rate of the national average. For individual coverage there was very little use of this type of health care service in North Carolina. Medicare Advantage patients had non-physician health care visits at a frequency approximately 30% below the U.S. average. North Carolina does not offer a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Non-physician care tends to be an expensive form of treatment. The reason non-physician visits are expensive is that many times these are visits to outpatient facilities. Most outpatient facilities are owned and operated by hospitals. While hospital owned and operated medical facilities are less expensive than a hospital, oftentimes they are more expensive than a doctor visit.

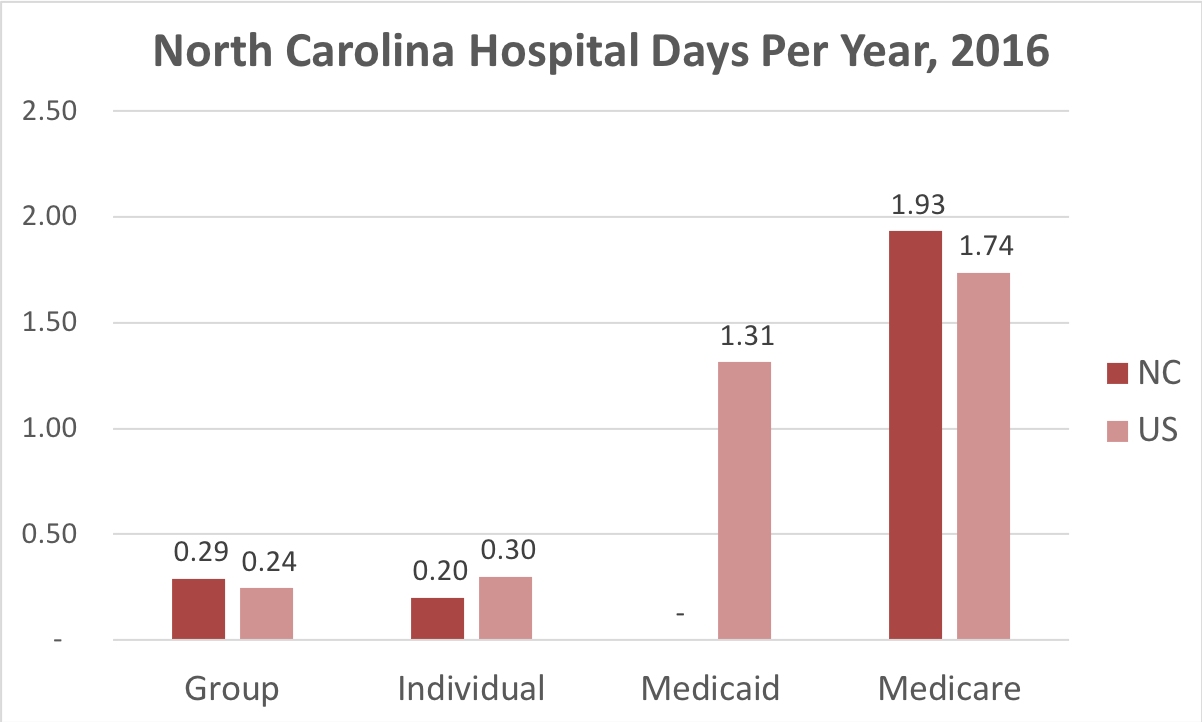

Average Number of Days NC Residents Spent in the Hospital

The number of days in the hospital are counted starting with the day the patient is admitted. The last day is not counted, unless the first and last day are the same day.

North Carolina residents, with all types of insurance coverage, spent roughly an equivalent number of days in the hospital as the national average. North Carolina does not offer a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Health Care Market Competitive Dynamics

Most states have laws requiring new health care facilities to be approved by special boards. These boards are known as “certificate of need” (CON) boards. The purpose of these boards is to certify there is need for new facilities. CON boards have the effect of reducing the level of competition, which results in higher prices for the services provided.

To quantify the effect of legislation that minimizes competition, ValChoice has calculated the difference in health care cost between states with and without CON boards. Using a simple average calculation, states with CON requirements have an average cost for health care that is $664 more per person insured than states without CON requirements.

States included in the calculations as having CON requirements include the following: Alabama, Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire*, New Jersey, New York, North Carolina, Oklahoma, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, Washington, West Virginia and Wisconsin*. Other states do not have CON board certification requirements.

*New Hampshire and Wisconsin are included as having CON requirements for the reason the recent modifications in CON laws have not yet had a material impact on the cost of health care in the state.

The Effect of Insurance Deductibles on The Cost of Health Care

NC residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $5,318 with a relatively common $6,000 deductible has an effective price of nearly $11,000, if they use their insurance.

Overview of The Different Types of Health Insurance Plans

Individual Coverage

The individual health plan is for people who do not qualify for other types of insurance. This type of insurance is often referred to as Obamacare or the Affordable Care Act (ACA). Self-employed and unemployed people who are not eligible for employer provided insurance often purchase individual coverage. The premiums earned under this type of insurance are based on the premiums paid by the individual. Tax credits provided to make the insurance affordable are not included in the premiums earned. Individual coverage includes all types of plans. The basic plan types are referred to as Bronze, Silver and Gold Plans.

Group Coverage, Also Known as Employer-Sponsored Health Insurance

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), Point-of-Service (POS) Plans and High-Deductible Health Plans.

Medicaid and CHIP

Medicaid total cost and enrollment numbers include the Children’s Health Insurance Program (CHIP). These programs provide health insurance coverage that is not included under Medicare coverage. Examples of the type of health coverage provided includes doctor visits, hospital expenses, nursing home care and home health care. Medicaid also covers long-term care costs, both in a nursing home and at-home care. The costs associated with medicaid is inclusive of both state and federal spending.

The data on how Medicaid patients use health services is based on Medicaid managed care. Medicaid managed care provides for the delivery of Medicaid health benefits and additional services through contracted arrangements between state Medicaid agencies and managed care organizations (MCOs) that accept a set per member per month (capitation) payment for these services. The capitation model is unique in that it is not a pay for service. Instead, this is a set fee paid per member, per month, whether or not the person seeks service.

Medicare and Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans (MMSAPs).

Looking for information about North Carolina car and home insurance?

How much does North Carolina car insurance and home insurance cost?

The ValChoice car insurance calculator and homeowners insurance calculator were built so you could know what's a fair price for your insurance.

Find the Best Car Insurance and Homeowners Insurance in North Carolina

Find Out How Your North Carolina Car Insurance and Home Insurance Companies Rate

Special Offer: Get a Premium Rating -- Includes Claims Handling Score (a $9.95 value) -- for Free